Foundry sustainability in 2026 puts the industry in a uniquely demanding position. Every major manufacturing sector depends on cast components, yet casting remains one of the most energy-intensive and carbon-heavy segments of industry. The coming year is not about distant visions; it is about whether foundries can turn technology pilots, policy promises, and recycling targets into measurable, defensible reductions in emissions and cost. This report provides a global, evidence-based look at foundry sustainability 2026, identifying where the bottlenecks lie and which regions are moving fastest.

In This Article

1. The big three levers for Foundry Sustainability in 2026

Short-term decarbonisation depends overwhelmingly on steps that already work at industrial scale.

Secondary aluminium and steel deliver the fastest impact. Recycled aluminium requires about 5% of the energy needed for primary smelting, which explains why European Aluminium has placed scrap availability and quality at the centre of its 2026 roadmap. Foundries that secure stable, clean scrap streams cut embedded emissions and benefit economically from lower raw-material cost volatility.

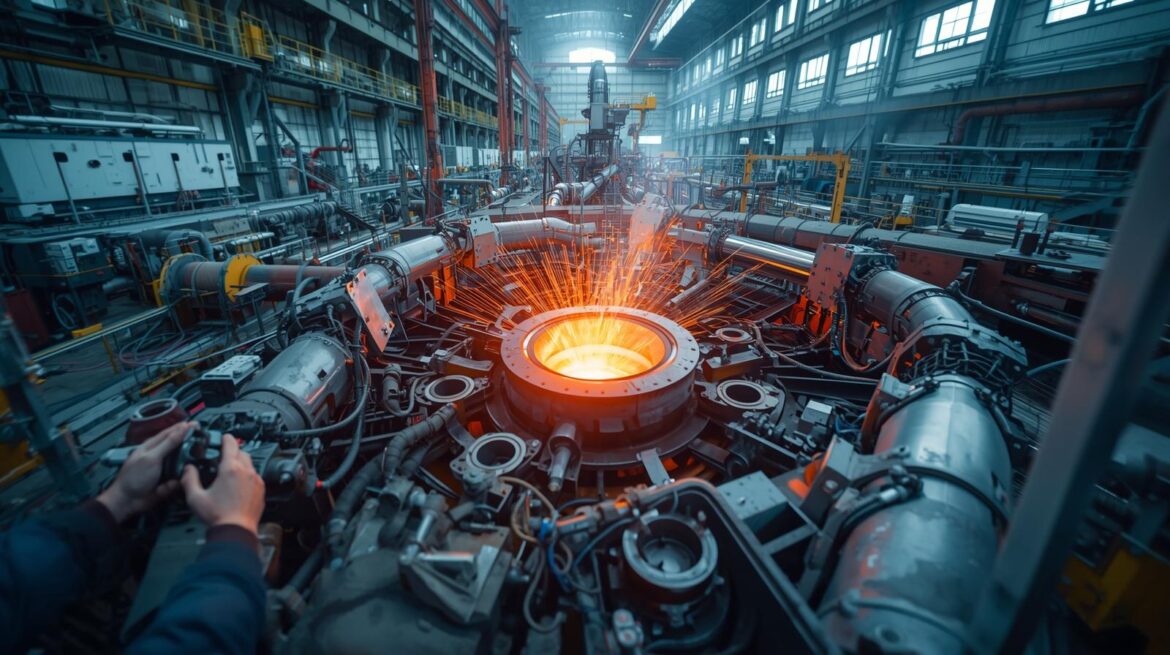

Electrification of melting using induction or medium-frequency electric furnaces is accelerating where clean electricity is available. The UK Cast Metals Federation reports measurable CO₂ reductions in foundries that have replaced gas-fired melting with induction systems. In 2026 more retrofits are expected across Europe, North America and selected Asian clusters with access to low-carbon grids.

Digital process control is the multiplier. Digital twins, energy-aware furnace controllers and predictive analytics reduce scrap rates and cycle times while stabilising energy use. These systems are no longer speculative; they are off-the-shelf solutions with clear ROI. Foundries adopting all three levers—scrap strategy, electrification and digitalisation—are likely to be the most competitive in 2026.

2. Hydrogen and CCS: progress without scale

Hydrogen and carbon capture dominate headlines, but both remain limited in practical deployment for the foundry sector in 2026.

Hydrogen is technically feasible for burners and enriched combustion, yet green hydrogen price and infrastructure barriers restrict adoption to pilots. Italy, Germany and the UK have ongoing trials, but widespread industrial implementation is unlikely before 2030.

Carbon capture remains economically suited for large emitters like steel and cement. Most foundries are mid-sized, scattered facilities where CCS cost per tonne is prohibitive. A few cluster-based demonstrations may advance in 2026, but operators should not rely on CCS as a near-term decarbonisation tool.

3. Circularity: 2026’s hidden competitive driver

The world talks about hydrogen, but scrap quality and access decide real-world decarbonisation speed.

Europe is moving fastest in building coordinated recycling chains, supported by policy frameworks and scrap-quality strategies.

North America shows strong private-sector investment where renewable power is cheap.

Asia, particularly India and China, faces grid constraints but is advancing through cluster-level initiatives, such as the Kolhapur foundry decarbonisation programme.

Circularity is no longer about environmental goodwill. It is a direct commercial advantage. Foundries with certified low-carbon recycled feedstocks are beginning to access price premiums in automotive and aerospace supply chains.

Circularity is the engine behind foundry sustainability 2026.

4. Industry 4.0 as the enabler

These capabilities align with the broader Industry 4.0 trends for 2025 which define the smart manufacturing landscape.

Data-driven operations are now central to sustainability. Digital twins shorten ramp-up phases, predictive maintenance cuts unplanned downtime, and IIoT sensors help track per-part energy consumption. These capabilities matter more as parts get larger like gigacastings in automotive or production mixes become more complex.

Smaller foundries often lack internal digital skills, which makes platform partnerships and cluster-based digital hubs essential to scaling adoption.

5. Regional fragmentation: why 2026 progress will be uneven

The sustainability map in 2026 is shaped by electricity grids, incentives and industrial policy.

Europe leads in policy alignment, recycling infrastructure and industry roadmaps, although high electricity prices still limit electrification in several countries.

North America benefits from cheaper renewable power and private investment in clean manufacturing.

Asia shows dual-speed development: large modern facilities advance quickly, while smaller regional clusters face cost and grid barriers.

These differences matter. A foundry switching to electric melting in a coal-dominated grid may barely reduce net CO₂ compared to gas-fired operations.

6. Practical steps for Foundry Sustainability 2026

| Priority Area | Action for 2026 | Impact Level |

| Metal Sourcing | Secure high-quality scrap | High (CO2 & Cost) |

| Energy | Electrify melting processes | High (Decarbonization) |

| Digital | Deploy energy-aware controllers | Medium (Efficiency) |

To achieve foundry sustainability in 2026, operators should follow this realistic priority list:

- Conduct an energy and material audit to establish baseline emissions;

- Secure high-quality secondary metal procurement;

- Electrify melting where grid capacity and economics allow;

- Deploy at least one digitalisation pilot (digital twin, predictive maintenance, energy control);

- Explore cluster partnerships for hydrogen, CCS or recycling infrastructure;

- Establish transparent, verifiable CO₂ accounting for OEM customers.

7. Outlook: cautious but grounded optimism

Foundries are progressing meaningfully, but unevenly. Induction melting, recycling strategies and digitalisation will define the winners in 2026. Hydrogen and CCS will continue evolving but remain out of reach for most operators in the short term. The companies that combine circularity, electrified melting and verified low-carbon products will gain business advantages far sooner than those waiting for a technological miracle.

Sustainability in 2026 is not about hype. It is about practical engineering, realistic economics and measurable results.

Sources (2024–2025, industry-verified)

Cast Metals Federation (UK)

Roadmap to a Globally Competitive Net-Zero UK Foundry Sector

Reports on induction melting efficiency and fuel-switching results

https://www.castmetalsfederation.com

European Aluminium

Strategy for the Long-Term Availability and Quality of Aluminium Scrap in Europe

Circularity and recycling performance statistics (2023–2025)

https://european-aluminium.eu

Foundry-Planet Industry Coverage

Digitalisation trends, energy-aware furnace control systems and global sustainability insights

https://www.foundry-planet.com

Hydro Aluminium

Aluminium recycling energy-use data and lifecycle emissions facts

https://www.hydro.com

Italpress / Italian Industrial Analysis

Reports on hydrogen in foundries and industrial decarbonisation projects

https://www.italpress.com

Horizon Europe / European Commission

ERA Action 16 – Industrial decarbonisation coordination

Cross-sector sustainability policy and carbon-pricing frameworks

https://research-and-innovation.ec.europa.eu

Asar Engineering / Asia Foundry Market Data

Case studies on Indian foundry clusters (e.g., Kolhapur)

Regional sustainability and electrification reports

https://www.asarengineering.com

RX Global (ALUMINIUM Fair)

ALUMINIUM / ALUMINIUM 2026 event sustainability themes and circularity programmes

https://www.aluminium-exhibition.com

Reuters Clean Industry & Metals Coverage

North American and Australian investment trends in low-carbon metals and electrification

https://www.reuters.com

Induction Furnace Technical Sources (Judian / Industry Suppliers)

Efficiency data, predictive maintenance, and induction melting performance

https://www.induction-furnace.com