London / Washington – Global industry faces an energy and cost crunch as 2026 begins, with sectors entering the year under synchronized pressure from rising operational costs and severe energy constraints, according to reports from the IMF, McKinsey, Gartner, and the WEF.

The coordinated data signals a year defined by a growing gap between rapid technological adoption and the physical limits of global infrastructure.

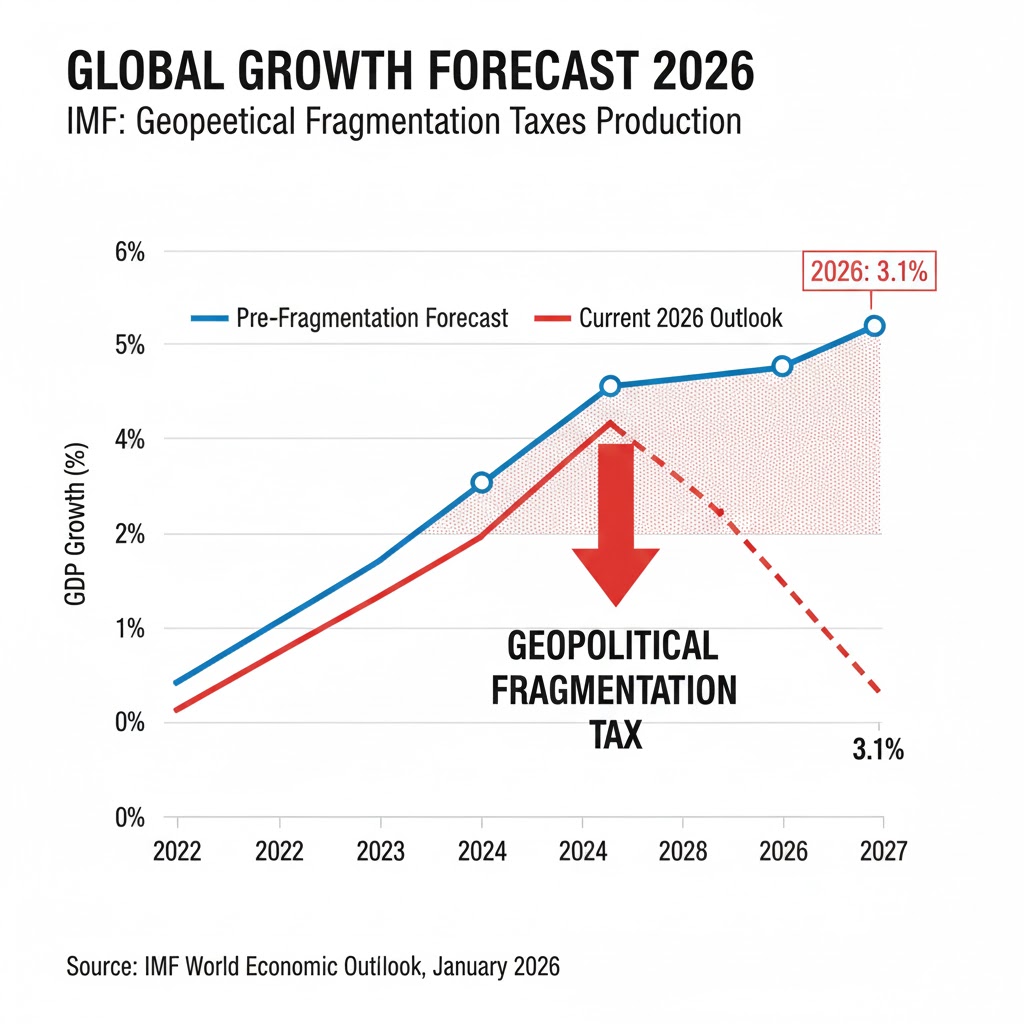

IMF: Geopolitics to Drag on Growth

In its January World Economic Outlook, the International Monetary Fund (IMF) projected global growth to hold at 3.1% for 2026. However, the Fund warned that “geopolitical fragmentation” is now a permanent tax on production. Heavy industry and automotive sectors are reporting extended lead times and volatile input costs as supply chains for raw materials remain disrupted.

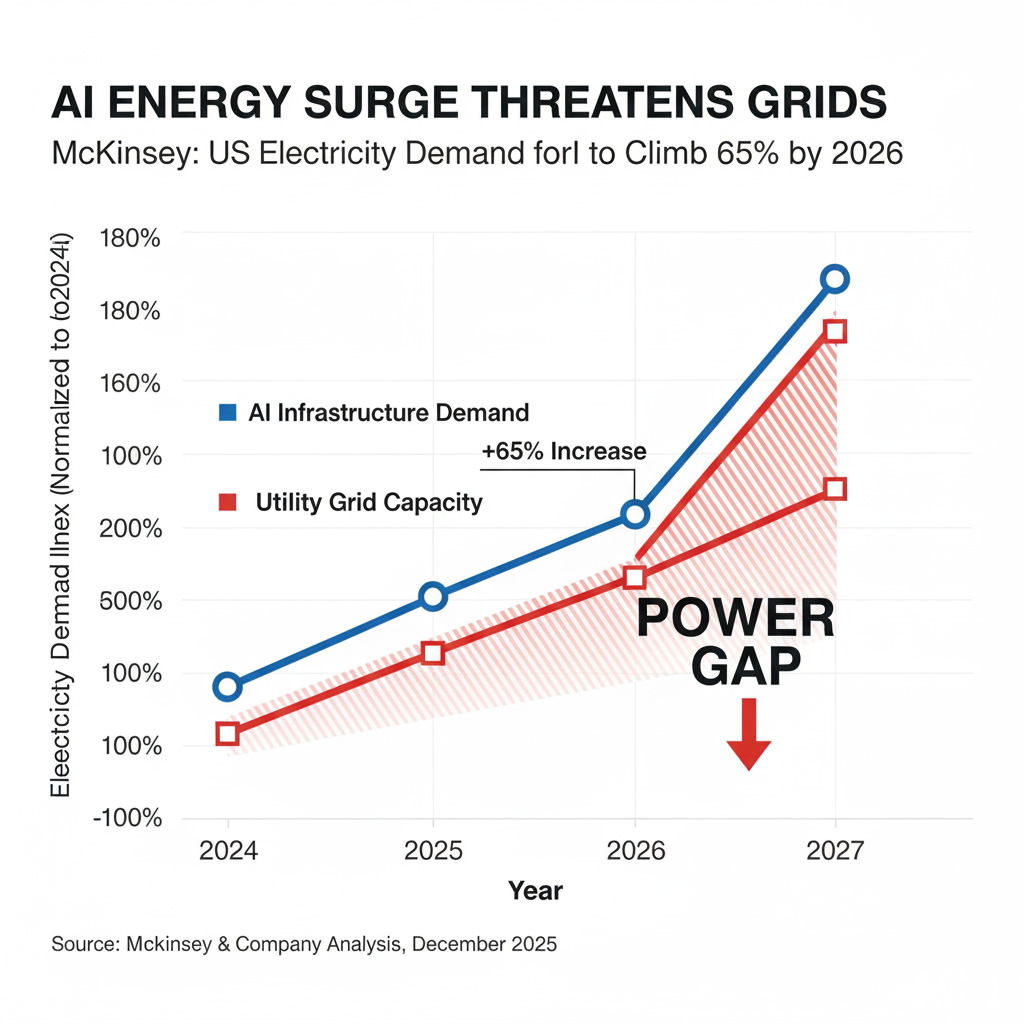

McKinsey: Energy Cost Crunch and AI Infrastructure

A new analysis by McKinsey & Company reveals that the energy required to fuel AI infrastructure is outpacing utility capacity. In the United States, electricity demand for AI-related projects is expected to climb by 65% in 2026.

The report notes that in several key industrial corridors, the volume of new grid connection requests for AI data centers already exceeds current supply limits. This “power gap” is now impacting traditional manufacturers who are competing for the same limited energy resources.

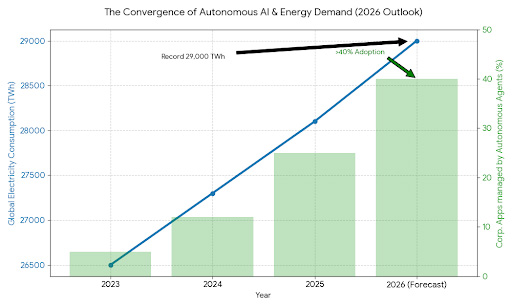

Gartner & IEA: Autonomous Systems Reach Record Highs

Data from Gartner indicates that more than 40% of corporate applications will be managed by autonomous agents by mid-2026. This shift is a primary driver behind the International Energy Agency’s (IEA) latest forecast, which sees global electricity consumption hitting a historic 29,000 TWh this year. The IEA warns that long lead times for grid expansion remain a critical bottleneck for industrial scaling.

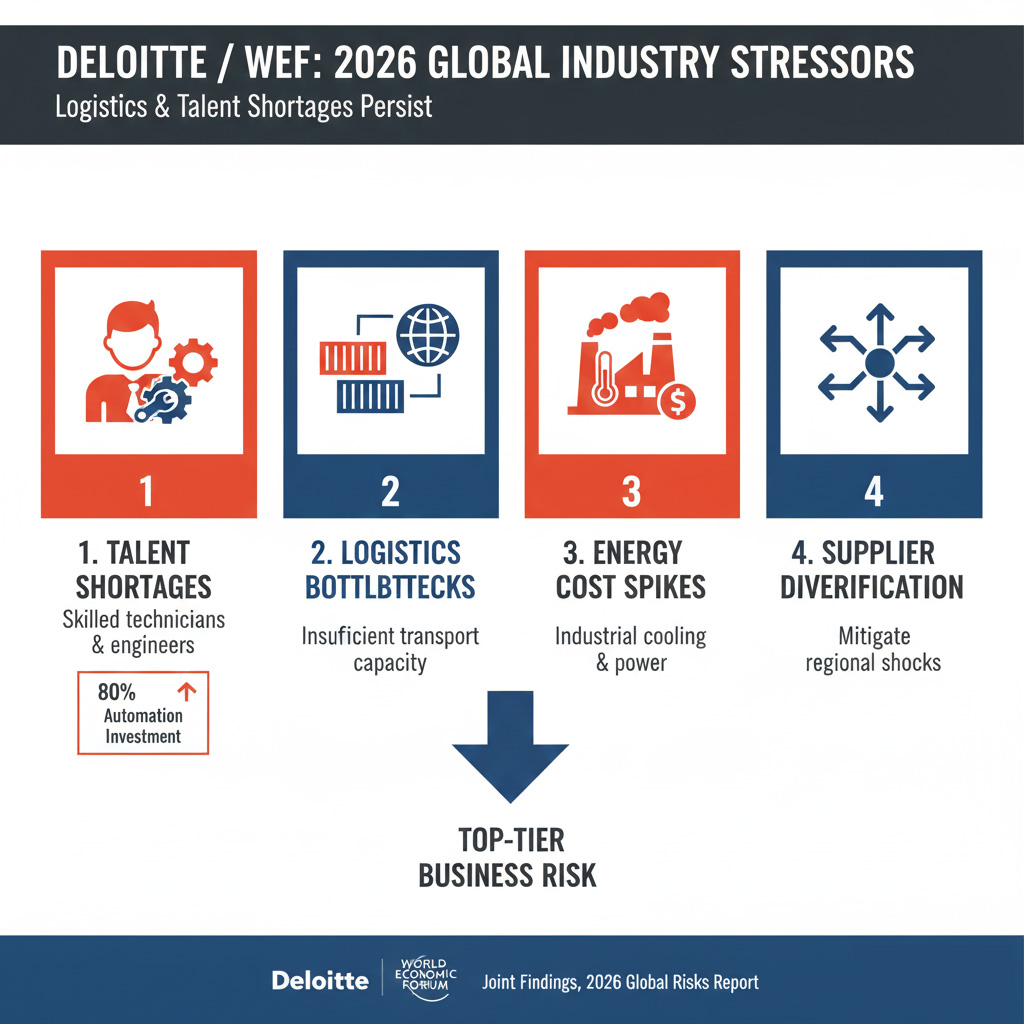

Deloitte / WEF: Logistics and Talent Shortages Persist

Despite 80% of manufacturers increasing investments in robotics and automation, logistics remains a top-tier business risk. Joint findings from Deloitte and the WEF highlight four primary stressors for 2026:

- Critical shortages of skilled technicians and engineers.

- Insufficient capacity in major global transport corridors.

- Spiking costs for industrial cooling and energy.

- Urgent requirement for supplier diversification to mitigate regional shocks.

The Bottom Line

The consensus points to a year of “infrastructure friction”. While AI and automation are being integrated at record speeds, the underlying power and logistics systems are struggling to keep pace. For global industry, 2026 will be a test of operational resilience and energy efficiency as a primary competitive advantage—making strategies like AI predictive maintenance for small factories essential for maintaining margins in a high-cost environment.

Reference Sources

- IMF: World Economic Outlook Update, January 2026.

- McKinsey & Company: The AI Infrastructure Challenge: Scaling Beyond the Grid, December 2025.

- Gartner: Predicts 2026: Agentic AI and the Future of Enterprise Applications, August 2025.

- IEA (International Energy Agency): Electricity Mid-Year Update 2025/2026 Forecasts.

- World Economic Forum: Global Risks Report 2026 (in collaboration with Deloitte).